Did you know that renting out part of your home could trigger a partial change in use which can impact your taxes?

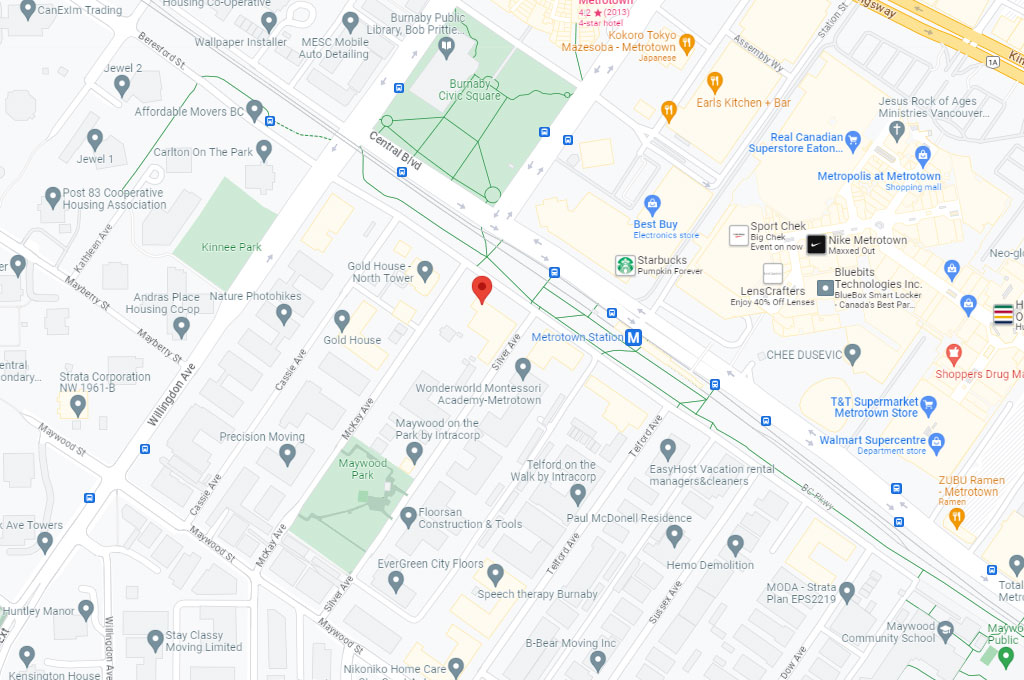

At JLT CPA we focus primarily on real estate tax issues and today I’d like to cover what we call a ‘partial change in use’. It can be a small change in how you use your personal residential real estate yet can trigger a bigger impact on your taxes.

A good example of partial change in use of your property is when you decide that you’re going to rent out your basement suite to a tenant.

You should know that the Canada Revenue Agency (CRA) considers that to be a ‘deemed disposition’ of a pro rata portion of your property. Any time there is a deemed disposition, that action gives rise to potential tax issues like capital gains.

It may also give rise to future tax issues on the eventual sale of your property. So, you can see that these issues are very important to examine with a licensed and experienced CPA.

Are there times the CRA does NOT consider a rental to a tenant to be a change in use?

Yes. When you are renting out your property, the CRA would consider there not to be a change in use when all three of these criteria are met:

-

- if there are no structural changes to the property

-

- as long as the income producing component of your property is ancillary to the overall use as your principal residence

- if you do not claim any capital cost allowance on your income tax return in respect of the property.

If you’d like some more guidance about partial or complete change in use of your residential real estate, you can give me a phone call or shoot me an email.

Join here to see short videos from JLT CPA on residential real estate and real estate taxes in general.

Get updates on Canadian tax news that affects you when you build, buy or sell residential real estate. Subscribe to our BLOG here.