If you are planning to rent out your home, or if during the year you’ve moved out of your home and have begun to rent it out, you’ll want to pay close attention.

Likewise, if you were renting out a home and got your tenants to move out and have moved back in to use as your own principal residence, these money saving tips also apply to you.

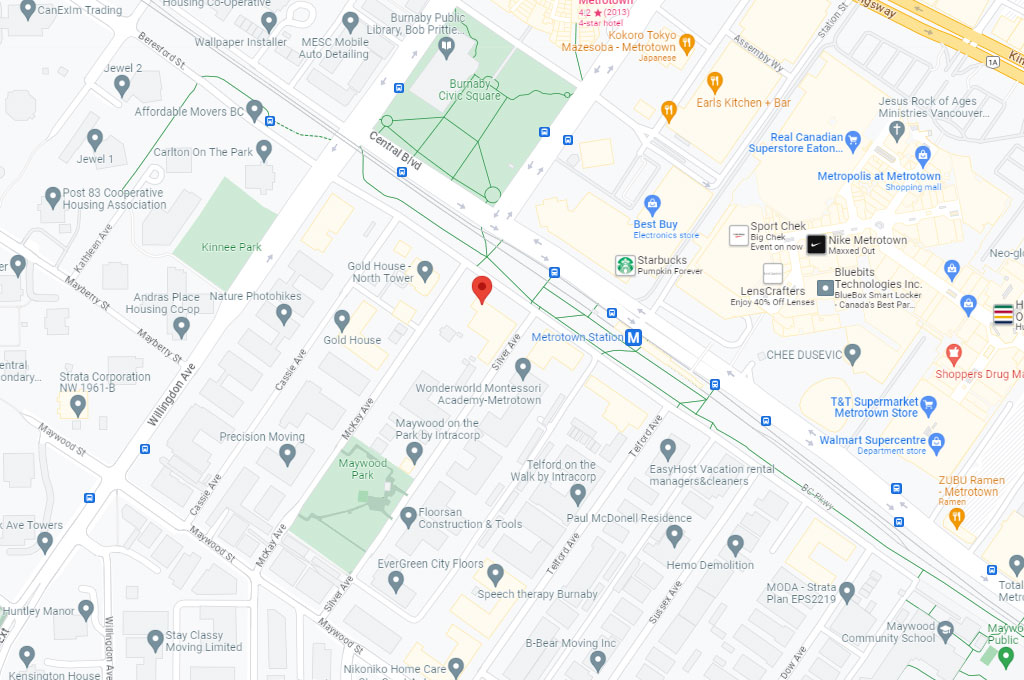

Let’s first look at how the Canada Revenue Agency (CRA) might view a complete change in use: Any time you use a property for one purpose, such as your own occupancy or a residence for personal use, and then you change that for an income producing purpose such as renting it out, you enter into a complete change in use.

This is important to you, because whenever you change use of a property from either personal use to income producing use or vice versa, there is something called a ‘deemed disposition’.

A deemed disposition gives rise to taxes on the capital gain UNLESS you qualify for an exemption such as the ‘principal residence exemption’.

For today, just know that if you move out of your property and start renting it out, you will trigger potential tax issues.

As the homeowner, there are elections available for you that allow you to defer the capital gain. At JLT CPA we can help you with those elections.

The purpose of the election is to allow you to not pay any taxes on the capital gain until your residential property is actually sold to a third party. That could be many years down the road. If you can kick your taxes down many years, you are all the better for it.

Find yourself in one of these situations?

Feel free to call me directly or shoot me an email. Together, we can explore the solutions to save you money on your plans for your residential real estate property, now.

Subscribe here and be notified when new posts are up on the latest tax news that affects you.

Find us on FACEBOOK

See us on YouTube